Key Takeaways

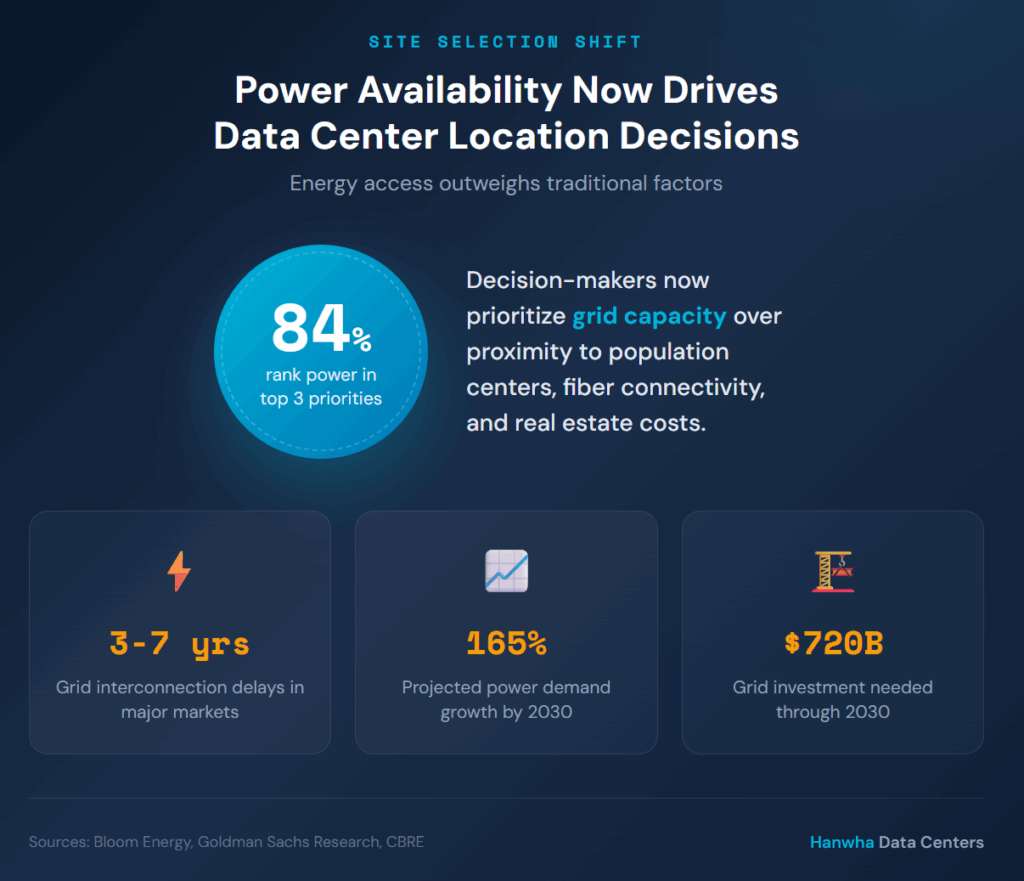

Power availability has fundamentally reshaped how organizations approach data center site selection, with energy access now outweighing traditional location factors like proximity to population centers.

- 84% of data center decision-makers rank power availability among their top three site selection considerations, making it the dominant factor in infrastructure planning

- Grid interconnection delays now extend three to seven years in major markets, forcing developers to pursue alternative power strategies and secondary locations

- Powered land transactions in the 250-500 MW range have become the new standard, with sites offering rapid power delivery commanding significant premiums

- Organizations that secure reliable power infrastructure today will define competitive positioning in the AI economy; those that wait will face increasingly constrained options.

Why Has Power Availability Changed Data Center Site Selection?

The traditional playbook for data center infrastructure development has been completely rewritten. Where proximity to major population centers, fiber connectivity, and real estate costs once drove location decisions, energy access has emerged as the singular constraint determining where new facilities can actually be built.

According to CBRE’s North America Data Center Trends report, power availability and infrastructure delivery timelines remain the most decisive factors shaping site selection, leasing activity, and pricing across all major U.S. markets. This shift represents a fundamental transformation in how digital infrastructure gets developed.

The numbers illustrate the magnitude of this change. According to the Bloom Energy Data Center Power Report, 84% of data center decision-makers now rank availability of power among their top three considerations when evaluating new sites. This marks a dramatic departure from even five years ago, when location, connectivity, and tax incentives dominated site selection discussions.

What’s driving this transformation? The explosive growth of AI workloads has created power demands that existing grid infrastructure simply cannot accommodate. Traditional data centers might draw 30 megawatts of power. Modern AI facilities require 200 megawatts or more, with individual equipment racks demanding 80-150 kilowatts compared to 15-20 kilowatts in conventional environments.

How Are Grid Constraints Reshaping Site Selection Strategy?

The bottleneck isn’t land availability or construction capability. The constraining factor is power delivery. Major markets across North America face severe grid limitations that are fundamentally altering where data centers can be built and when they can become operational.

Grid interconnection queues have stretched to five years or longer in many regions. According to research from the World Resources Institute, power constraints are extending data center construction timelines by 24 to 72 months in affected markets. This timeline extension transforms project economics and competitive dynamics entirely.

Northern Virginia offers a stark example. Long considered the data capital of the world, the region now faces unprecedented constraints. New facilities encounter extended wait times for adequate grid connections, with some utilities requiring complete transmission infrastructure upgrades before they can support additional large-scale operations. The region’s vacancy rate has plummeted to record lows, creating intense competition for the limited capacity that exists.

| Market Challenge | Impact on Site Selection |

| 3-7 year grid interconnection delays | Forces developers to secondary markets |

| Transmission upgrade requirements | Adds significant project costs and timelines |

| Utility minimum bill structures | Creates financial pressure for rapid deployment |

| Limited substation capacity | Restricts available development parcels |

| Interconnection queue backlogs | Requires early commitment to power procurement |

Similar dynamics are playing out across other primary markets. According to CBRE market analysis, Silicon Valley posted the strongest pricing growth among core markets in the first half of 2025, with large-scale pricing increasing nearly 20% amid persistent power constraints. Chicago saw comparable gains reflecting a shortage of large contiguous blocks of space and growing delays in power delivery timelines.

What Does a Data Center Power Availability Strategy Look Like Today?

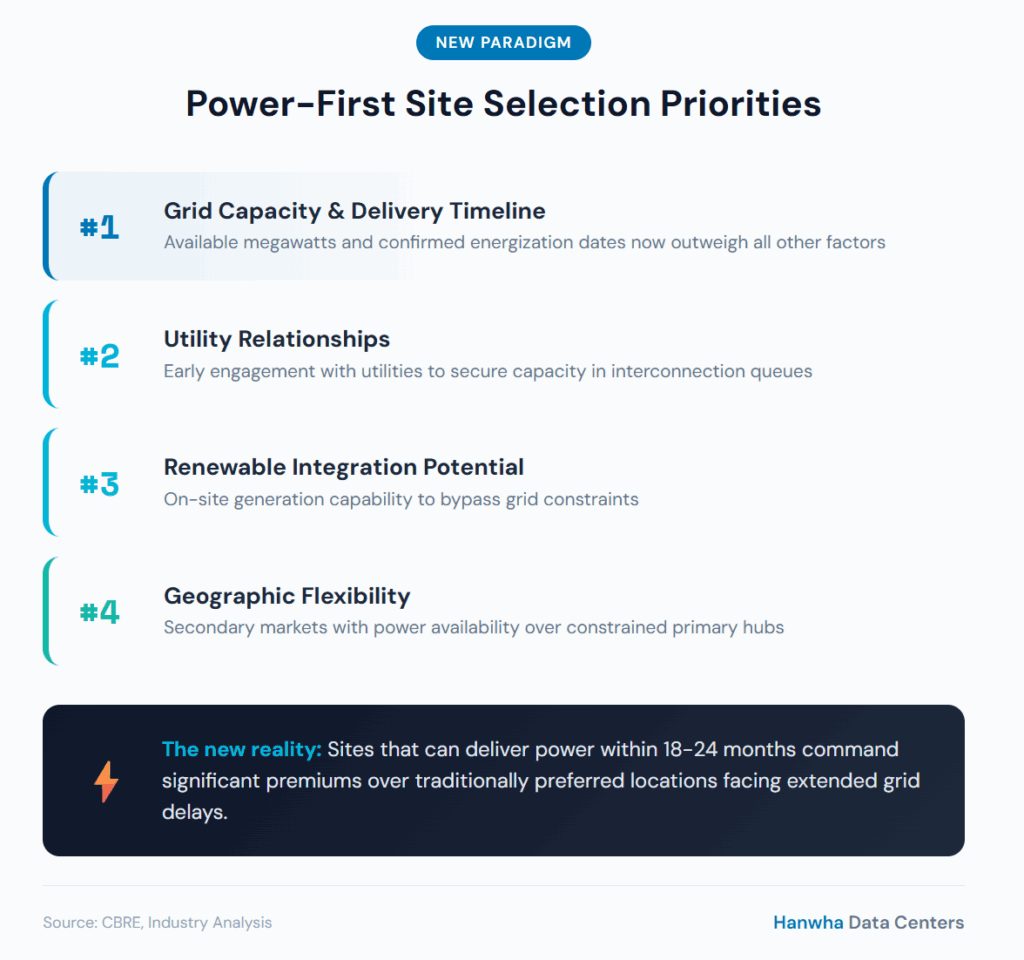

The industry has adopted what experts call a “power-first development” approach, where site selection begins with available generation capacity rather than proximity to customers or fiber infrastructure. This represents a complete inversion of traditional real estate logic.

Developers are now sourcing parcels within close proximity to substations and locking in power purchase agreements before finalizing land acquisition. The most sought-after sites are those that can offer power within 18-24 months. Sites requiring longer timelines, regardless of other favorable attributes, face significant competitive disadvantages.

Goldman Sachs Research projects that data center power demand will surge 165% by 2030 compared to 2023 levels, equivalent to adding another top-10 power consuming country to global demand. Meeting this growth will require approximately $720 billion in grid spending through the end of the decade.

The power requirements for AI facilities have created an entirely new category of infrastructure development. Organizations cannot simply scale existing approaches. The magnitude of power demand requires comprehensive planning that integrates land acquisition, utility relationships, renewable generation, and grid interconnection from the earliest stages of project development.

The Rise of Powered Land Transactions

The real estate dynamics for data center development have shifted dramatically. Powered land transactions in the 250-500 MW range have become the most common deal structure, with several transactions exceeding this capacity. The critical variable isn’t acreage or location but rather confirmed power availability and delivery timeline.

CBRE’s analysis confirms that while location remains an important factor, it has become less critical in site selection. Tertiary and rural markets have seen unprecedented deal activity specifically for powered land. Developers are willing to accept geographic trade-offs in exchange for reliable power delivery on compressed timelines.

This creates opportunities in markets that might have been overlooked under traditional site selection criteria. Regions with available grid capacity, favorable utility relationships, and streamlined permitting processes are attracting development that would previously have concentrated in major metropolitan areas.

Which Markets Are Winning the Data Center Power Availability Race?

The geographic distribution of data center development has fundamentally shifted. Markets that can deliver power quickly are capturing development that would have been unthinkable under previous location paradigms.

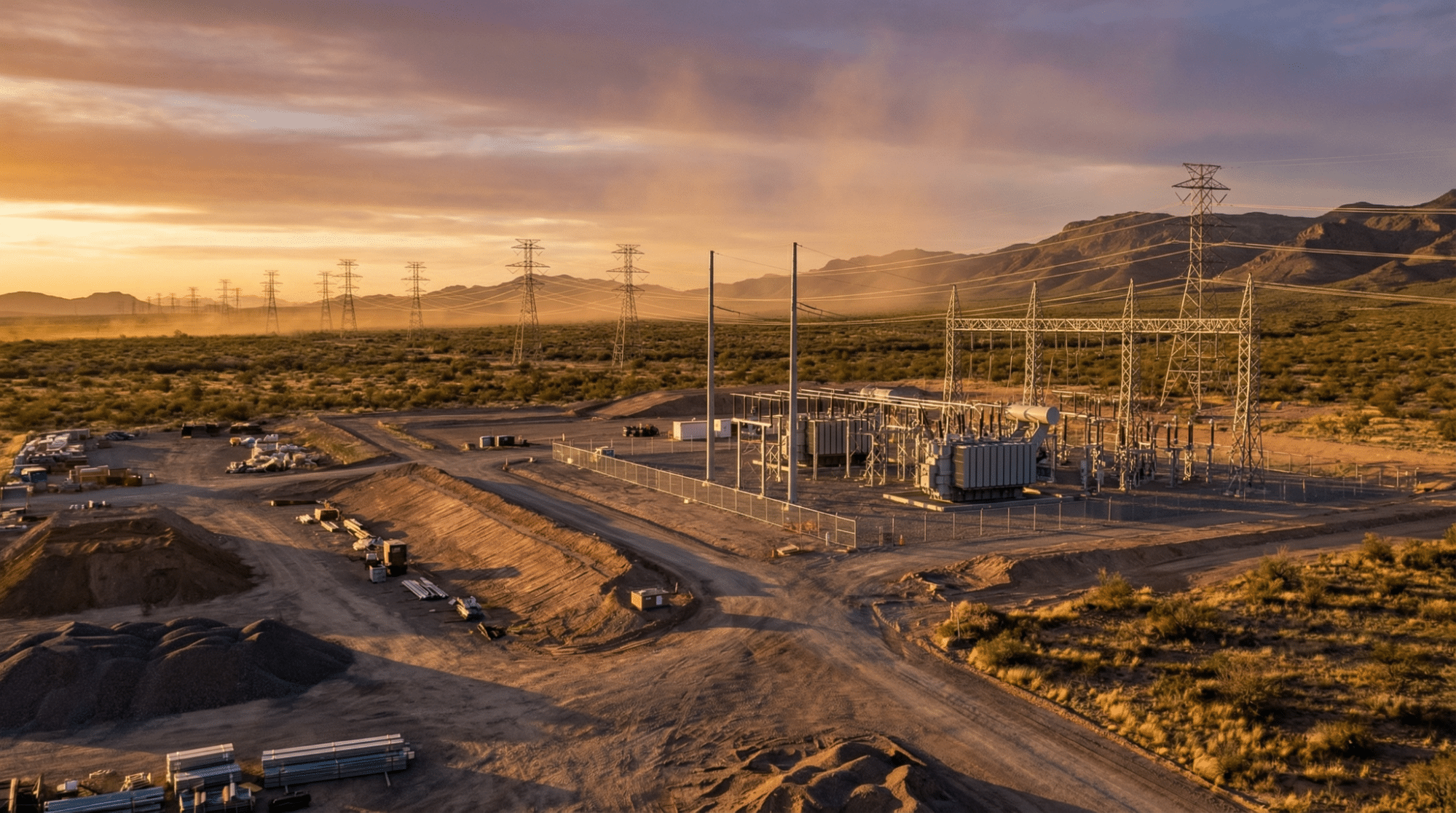

Phoenix has emerged as a major beneficiary of this shift. According to CBRE’s H2 2024 data center trends report, the market’s data center supply grew substantially, with utility providers actively working with developers to plan substations and ensure reliable power delivery.

Texas continues to attract massive investment due to its independent grid, business-friendly regulatory environment, and abundant land suitable for large-scale development. The state’s combination of available power capacity and favorable operating conditions has made it a preferred destination for hyperscale facilities.

Atlanta led all primary markets for net absorption in 2024, surpassing Northern Virginia for the first time. This reflects both available power capacity and proactive utility engagement that reduces uncertainty for developers facing compressed timelines.

| Emerging Market | Key Power Advantages |

| Phoenix, AZ | Strong utility partnerships, solar integration potential |

| Columbus, OH | Central location, expanding grid capacity |

| Tulsa, OK | Low energy costs, available land, tax incentives |

| San Antonio, TX | High-capacity grid, favorable regulations |

| Atlanta, GA | Utility investment, diverse power sources |

Secondary and emerging markets are expected to capture an increasing share of development as primary markets face mounting constraints. Organizations that establish relationships in these markets early will secure access to power capacity that becomes increasingly scarce as demand accelerates.

What Alternative Power Strategies Are Developers Pursuing?

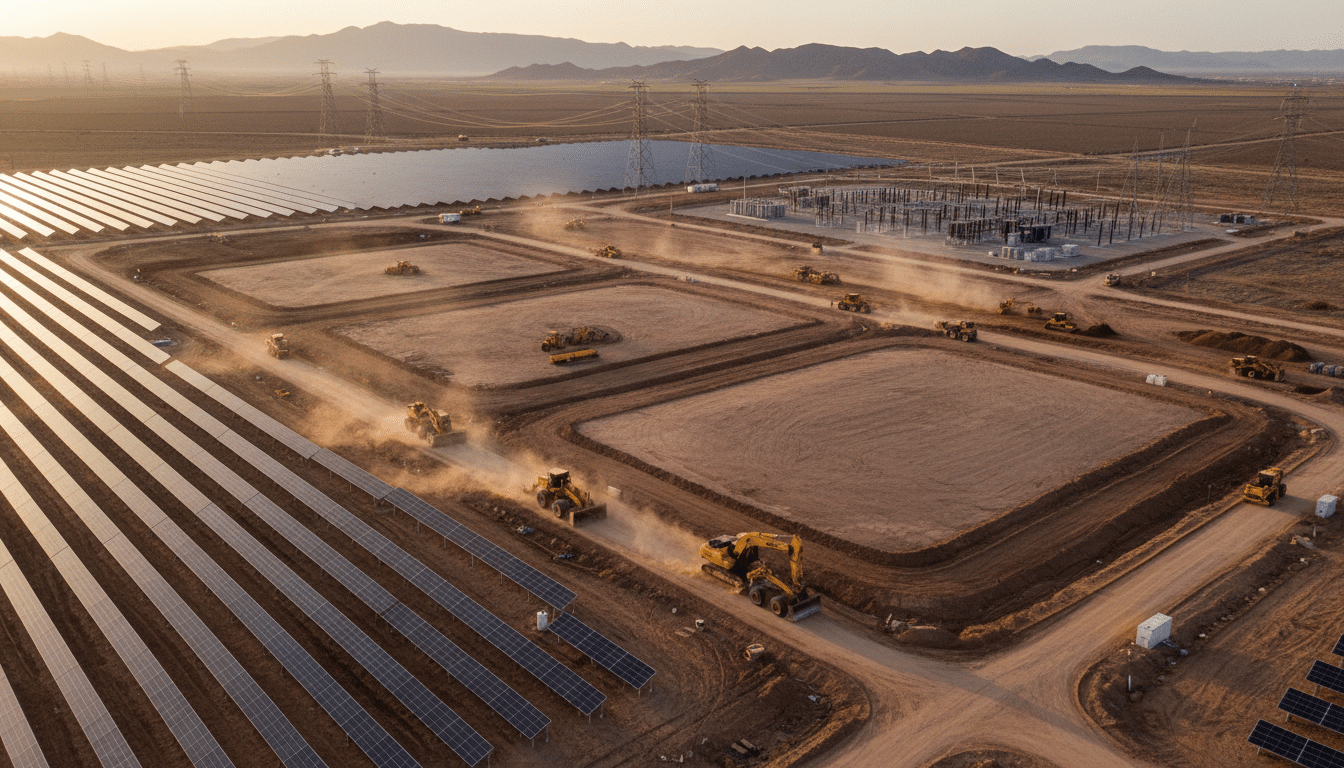

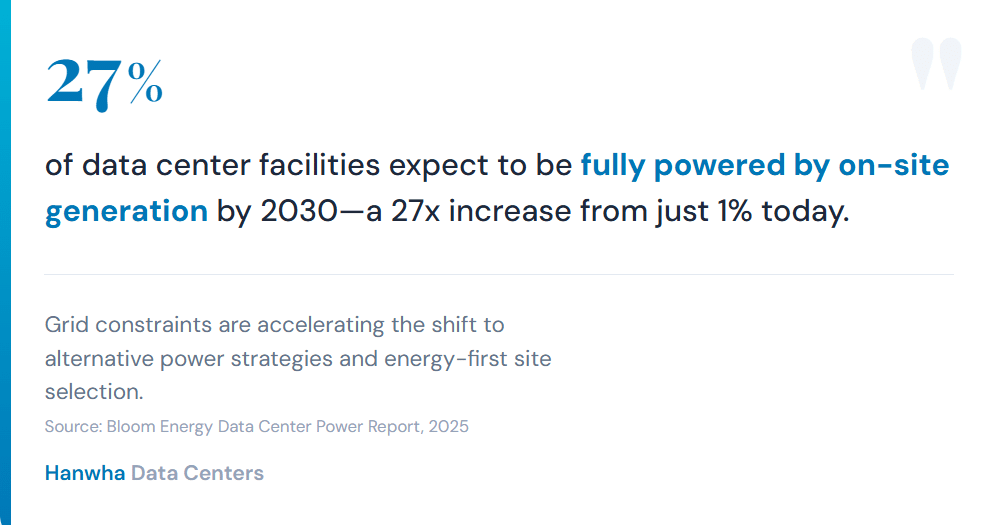

The gap between power demand and grid delivery capability has forced the industry to pursue alternative approaches that would have seemed impractical just a few years ago. On-site generation, hybrid systems, and direct utility partnerships are becoming standard components of site selection strategy.

According to industry research from Bloom Energy, facilities using some form of on-site generation for primary power are expected to increase dramatically by 2030, with more than a quarter of facilities expecting to be fully powered by on-site generation. This represents a fundamental shift from traditional grid-dependent operations.

The renewable energy integration approach has become central to solving power availability challenges. Solar installations paired with battery storage can be deployed on accelerated timelines compared to traditional grid infrastructure. These systems provide power availability that doesn’t depend on utility upgrade schedules.

Five Critical Power Strategies for Site Selection Success

- Early Utility Engagement: Building relationships with utilities before site acquisition creates visibility into available capacity and upgrade timelines that inform realistic project planning.

- Renewable Integration Assessment: Evaluating on-site generation potential expands the universe of viable sites beyond those with immediate grid capacity.

- Geographic Flexibility: Willingness to consider secondary markets unlocks power availability that constrained primary markets cannot provide.

- Phased Development Planning: Structuring projects to align power delivery with construction phases ensures capital efficiency and reduces timeline risk.

- Hybrid Power Architecture: Designing facilities to leverage multiple power sources creates resilience while maximizing available capacity.

The organizations succeeding in this environment are those treating power procurement as a strategic function rather than an operational detail. Energy companies specializing in data center infrastructure have emerged as critical partners for developers navigating this complex landscape.

How Does Power Availability Affect Data Center Economics?

The financial implications of power availability constraints extend far beyond site selection. Pricing dynamics across the industry now directly reflect the scarcity value of confirmed power capacity.

Wholesale colocation lease rates in primary markets have increased substantially over recent years. According to CBRE, the average monthly asking rate for large-scale requirements increased over 12% year-over-year in 2024, with further gains in 2025. The pricing gap between smaller and larger deployments continues to widen as AI and hyperscale workloads drive sustained demand for future-proofed capacity at scale.

In constrained markets, colocation increasingly behaves less like a traditional real estate product and more like a power access product. The deliverable megawatts on a timeline that customers can underwrite represent the true constraint.

For organizations evaluating build versus lease decisions, understanding AI data center power requirements becomes essential. The capital required to secure power independently often exceeds the cost of the physical facility itself, fundamentally changing project economics.

What Should Organizations Prioritize for Data Center Power Availability?

The competitive landscape for digital infrastructure has permanently changed. Organizations that established power positions in recent years secured advantages that will compound as constraints intensify.

The most successful approaches share common characteristics. They begin with power as the primary constraint and work backward to other site requirements. They establish utility relationships early and maintain them actively. They pursue geographic flexibility rather than insisting on traditional location preferences.

The future of AI data centers depends on solving the power availability challenge at unprecedented scale. Organizations evaluating site selection strategy should prioritize understanding the power landscape in target markets with the same rigor previously applied to real estate fundamentals.

Frequently Asked Questions

Why has power availability become more important than location for data center site selection?

Power availability has surpassed traditional location factors because AI workloads require 3-5 times more energy than conventional computing, creating demand that existing grid infrastructure cannot accommodate. Grid interconnection delays of three to seven years mean that even ideal locations without confirmed power capacity cannot support timely development. This has inverted traditional site selection logic, making energy access the primary constraint that other factors must accommodate.

How long do grid interconnection delays typically extend data center project timelines?

Grid interconnection delays in major markets now extend project timelines by 24 to 72 months depending on the required capacity and local utility conditions. Some markets face even longer delays when transmission infrastructure upgrades are required. This timeline pressure has made sites with faster power delivery paths significantly more valuable than those in traditionally preferred locations facing extended queues.

What are powered land transactions and why are they becoming the standard?

Powered land transactions involve the sale or lease of parcels that include confirmed power capacity and delivery timelines, not just the real estate itself. These transactions in the 250-500 MW range have become standard because developers recognize that land without power capacity cannot support development on competitive timelines. The value in these transactions is primarily the power access rather than the underlying real estate.

Which markets are gaining data center development due to power availability advantages?

Markets including Phoenix, Atlanta, Tulsa, San Antonio, and Columbus are gaining development specifically because they offer superior power availability compared to constrained primary markets. These regions combine available grid capacity with favorable utility relationships and streamlined permitting processes. This represents a geographic redistribution of data center investment driven primarily by energy access rather than traditional location factors.

Build Your Infrastructure on a Foundation of Available Power

The transformation in data center site selection, with power availability moving from secondary consideration to primary constraint, has reshaped the entire digital infrastructure landscape. Organizations that recognize this shift and adapt their strategies accordingly will capture the competitive advantages that define the AI era.

The window for securing favorable power positions is narrowing as demand accelerates faster than infrastructure can expand. Waiting for conditions to improve means accepting increasingly constrained options at premium pricing. Acting now means securing the energy foundation that makes AI capabilities possible.

Hanwha Data Centers specializes in developing powered land solutions that address the fundamental infrastructure challenge facing digital infrastructure today. To explore how energy campus development can accelerate your data center strategy, contact the team today.