Key Takeaways

AI and renewable energy convergence is creating an unprecedented infrastructure transformation that demands entirely new approaches to power delivery and land development for data centers.

- Data center power demand will surge dramatically by 2030, driven primarily by AI workloads that require 3-5 times more energy than traditional computing operations

- Grid interconnection bottlenecks create years-long delays in major markets, forcing organizations to pursue alternative power strategies including on-site generation and renewable energy campuses

- Renewable energy sources will supply nearly half of new data center electricity growth through 2030, with solar and wind leading deployment alongside emerging nuclear solutions

- Successful AI infrastructure requires integrated energy campus development that combines powered land, renewable generation, energy storage, and strategic grid connections from day one

Organizations that fail to integrate renewable energy strategies into their AI infrastructure planning will face operational delays, cost overruns, and inability to meet sustainability commitments.

The intersection of AI and renewable energy represents one of the most significant infrastructure challenges and opportunities of our generation. Artificial intelligence has triggered an energy revolution that traditional power systems simply cannot accommodate. According to the International Energy Agency, global data center electricity demand will more than double over the next five years, consuming as much electricity by 2030 as the entire nation of Japan consumes today. AI operations account for an increasingly significant portion of this explosive growth.

This surge creates immediate challenges for power infrastructure that was never designed to handle such rapid, massive load increases. But it also creates unprecedented opportunities for renewable energy integration at scales that can reshape how we think about energy delivery. The organizations and regions that successfully navigate this transformation will gain decisive competitive advantages in the emerging AI economy.

What Makes AI Data Center Energy Demands Different?

AI infrastructure operates fundamentally differently from traditional data centers. A single ChatGPT query requires 2.9 watt-hours of electricity compared to just 0.3 watt-hours for a standard Google search. These intensive computational requirements, multiplied across millions of daily interactions and continuous model training operations, create energy demands that challenge both traditional power infrastructure and conventional approaches to facility design.

Modern AI data centers require significantly higher power densities per rack compared to traditional configurations. This dramatic increase in power density means facilities need completely different approaches to power delivery, cooling systems, and grid connections. Training sophisticated AI models demands immense computing power running continuously for extended periods, with large-scale training operations consuming power equivalent to tens of thousands of average American homes.

The continuous nature of AI workloads presents another critical challenge. Traditional enterprise computing might peak and drop throughout the day, but AI training sessions and inference operations often run around the clock. This 24/7 demand pattern requires power infrastructure designed for maximum sustained load rather than average consumption patterns. Organizations planning AI infrastructure must account for these elevated, continuous energy requirements from the earliest stages of development.

Geographic concentration intensifies these challenges. Major data center markets are experiencing rapid facility growth that creates intense pressure on regional energy infrastructure and available grid capacity. Similar dynamics are playing out in Texas, Oregon, and emerging markets as organizations compete for increasingly scarce power resources.

How Are Grid Interconnection Challenges Limiting AI Growth?

The traditional electrical grid faces severe bottlenecks that threaten AI expansion. Grid interconnection timelines extend multiple years in advanced economies, with some major markets experiencing even longer delays. In PJM Interconnection, which serves 13 states including northern Virginia, peak load is projected to grow by 32 gigawatts from 2025 to 2030, with data centers comprising 30 gigawatts of that growth.

More than 12,000 active projects are currently seeking grid interconnection, representing 1,570 gigawatts of generator capacity and 1,030 gigawatts of storage. This massive backlog creates serious constraints for organizations attempting to rapidly deploy AI infrastructure. Utilities report that their interconnection queues have grown faster in single years than they previously saw in entire decades.

Transmission infrastructure limitations compound these challenges. The power system lacks sufficient extra transmission capacity and generation to serve dozens of gigawatts of new, high-utilization demand around the clock. Building new transmission infrastructure requires years of permitting, land acquisition, supply chain management, and construction. In Texas, CenterPoint Energy reported a 700% increase in large load interconnection requests, growing from 1 gigawatt to 8 gigawatts between late 2023 and late 2024.

Regional grid operators are implementing new requirements to address these constraints. Texas Senate Bill 6, passed in June 2025, requires new large-load customers to demonstrate the ability to remotely curtail load or switch to on-site generation during emergencies. PJM and other regional transmission organizations are developing similar frameworks that shift more responsibility for power reliability onto data center operators.

These interconnection challenges are forcing fundamental changes in how organizations approach AI infrastructure development. Waiting years for traditional grid connections is simply not viable in fast-moving AI markets where competitive positioning depends on rapid deployment. Forward-thinking organizations are pursuing alternative strategies that reduce grid dependency.

Why Is Renewable Energy Essential for AI Infrastructure?

AI and renewable energy integration has evolved from an environmental preference to a business imperative. Major technology companies have made ambitious sustainability commitments that directly influence their infrastructure decisions. Microsoft aims to be carbon negative by 2030, Google has committed to operating on 24/7 carbon-free energy by 2030, and Amazon plans to achieve net-zero carbon emissions by 2040.

These commitments are translating into massive renewable energy investments. Hyperscale operators have contracted substantial clean energy capacity to support their expanding operations. According to the IEA, renewables will meet nearly 50% of additional data center electricity demand growth through 2030, primarily through wind and solar photovoltaic deployment.

Renewable energy offers practical advantages beyond sustainability. Once operational, solar and wind facilities provide predictable, long-term cost structures that protect against fossil fuel price volatility. Power purchase agreements for renewable energy typically span 15-25 years, providing cost certainty that helps organizations plan their AI infrastructure investments with confidence.

On-site renewable generation reduces transmission losses and enhances energy security. Co-locating solar arrays and battery storage systems directly at data center sites can provide backup power capacity while minimizing grid dependency. This approach has gained significant traction as organizations seek faster paths to operational power that don’t require years-long interconnection processes.

Geographic distribution strategies optimize renewable energy access. Texas has emerged as a leading destination for AI infrastructure development due to its extensive wind and solar capacity, business-friendly regulatory environment, and available land for large-scale development. Similar dynamics are driving growth in other renewable-rich regions including the Southeast and Southwest United States.

What Renewable Energy Solutions Are Technology Leaders Deploying?

Power-First Development Approaches

Google has pioneered what the company calls a “power first” approach to data center development. Rather than building facilities and then seeking power connections, this strategy co-locates gigawatts of data center capacity with purpose-built renewable generation. New AI infrastructure comes online alongside its own clean power supply, eliminating interconnection delays and reducing dependence on congested grid infrastructure.

Microsoft has committed to massive renewable energy procurement through partnerships with energy infrastructure developers. The company has secured agreements for substantial renewable energy capacity delivery through 2030 to power its expanding data center operations. These large-scale commitments provide the financial backing necessary to develop new renewable generation at speeds that match AI deployment timelines.

On-Site Generation and Microgrids

Behind-the-meter configurations allow data centers to bypass traditional grid interconnection entirely by getting energy from generation facilities directly. This approach has become increasingly popular as interconnection queues have grown, with industry analysts noting significant growth in on-site generation projects announced in recent years.

Microgrid capabilities allow AI data centers to operate independently from the main electrical grid during emergencies or maintenance periods. These systems typically combine renewable generation, battery storage, and backup generation to ensure continuous power availability. Advanced implementations can even migrate workloads between facilities to optimize power utilization across multiple sites.

Hybrid Renewable Systems

Battery Energy Storage Systems bridge the gap between intermittent renewable generation and continuous AI workloads. These systems store excess energy during low-demand periods and release it during spikes, creating more self-sustaining energy ecosystems. Large-scale battery systems can provide grid stability, renewable energy integration, and backup power capabilities simultaneously.

Hybrid systems that combine renewables with natural gas generation provide reliability while maintaining lower carbon intensity than traditional fossil fuel operations. As of 2024, natural gas supplies over 40% of electricity for U.S. data centers, according to the IEA. Strategic hybrid approaches can reduce this dependency while ensuring the 24/7 reliability that AI operations require.

How Do Energy Campus Models Address AI Infrastructure Needs?

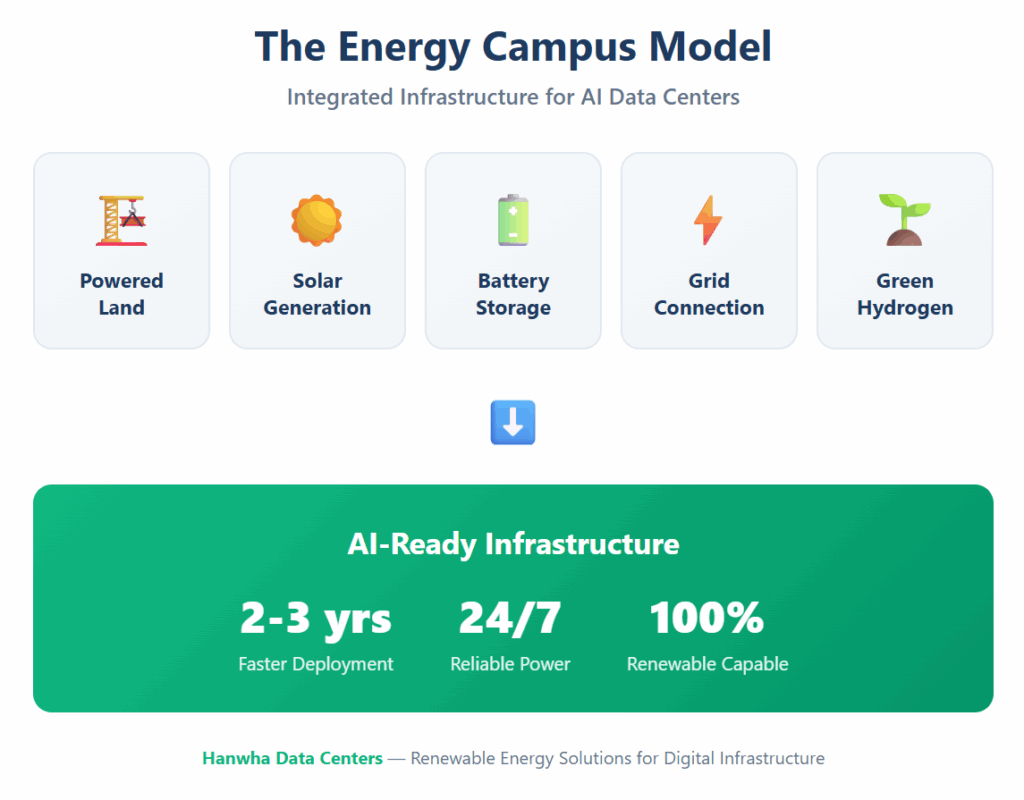

Energy campus development represents the most comprehensive approach to integrating AI and renewable energy infrastructure. These campuses combine renewable generation, energy storage, data center facilities, and grid connections into unified developments designed from the ground up to support high-performance computing requirements.

The energy campus model addresses multiple challenges simultaneously. By developing renewable generation capacity alongside computing infrastructure, organizations can secure long-term power supplies without waiting years for traditional interconnections. Strategic land acquisition in renewable-rich regions provides access to optimal solar and wind resources while positioning facilities near existing transmission infrastructure.

| Energy Campus Component | Primary Function | AI Infrastructure Benefit |

| Powered Land Development | Site acquisition and preparation for megawatt-scale deployment | Faster time-to-operation through pre-entitled, grid-ready parcels |

| On-Site Solar Generation | Direct renewable power delivery to computing facilities | Reduced transmission losses and grid dependency |

| Battery Energy Storage | Load balancing and backup power capacity | 24/7 operational reliability despite renewable intermittency |

| Grid Interconnection | Strategic utility connections for supplemental power | Redundant power pathways and demand response capabilities |

| Renewable Integration | Coordination of multiple clean energy sources | Achievement of sustainability goals while maintaining performance |

Renewable energy for AI data centers requires this integrated approach. Organizations that treat power infrastructure as an afterthought face delays, cost overruns, and operational constraints that limit their AI capabilities. Successful deployments integrate energy strategy into facility planning from day one.

What Role Will Emerging Technologies Play?

Nuclear Power Resurgence

Nuclear power is experiencing renewed interest as a carbon-free baseload complement to renewable energy. Small modular reactors offer dedicated data center power potential without massive infrastructure requirements. Major cloud providers are exploring nuclear partnerships to support their long-term power needs.

Technology companies view nuclear energy as an important part of their long-term power strategies. After 2030, small modular reactors are expected to play an increasingly important role in meeting data center electricity demand with carbon-free generation.

Green Hydrogen Systems

Hydrogen fuel cells provide an emerging backup power option that combines environmental benefits with operational reliability. These systems can operate continuously as long as fuel is available and produce only water vapor as a byproduct. Integration with on-site hydrogen production using renewable energy creates completely carbon-free backup power systems.

Green hydrogen also offers potential for long-duration energy storage that exceeds what current battery technologies can provide. When renewable generation exceeds immediate demand, excess electricity can produce hydrogen for later use. This capability becomes increasingly valuable as renewable penetration increases and storage requirements grow.

Advanced Geothermal Solutions

Next-generation geothermal technologies are gaining momentum as sources of carbon-free baseload power. Unlike solar and wind, geothermal generation provides constant output regardless of weather or time of day. Companies are developing enhanced geothermal systems that can access heat resources in locations previously considered unsuitable for geothermal development.

Critical Success Factors for AI and Renewable Energy Integration

Strategic Site Selection

Location decisions determine power availability, scalability, and environmental compliance. Organizations must evaluate multiple factors including proximity to renewable resources, available land for large-scale development, existing transmission infrastructure capacity, and regional regulatory environments. The most successful deployments occur in regions that combine abundant renewables with business-friendly policies and available land.

Texas exemplifies this combination. The state offers extensive wind and solar capacity, a deregulated electricity market that facilitates innovative power arrangements, and substantial available land for development. These factors have made Texas one of the fastest-growing data center markets in the United States, with projections showing substantial utility power demand growth.

Financial Structuring

Power requirements for AI data centers demand substantial capital investment in energy infrastructure. Organizations must structure these investments strategically to balance risk, cost, and operational requirements. Long-term power purchase agreements for renewable energy provide cost certainty while supporting the development of new generation capacity.

Revenue models vary by project structure. Some organizations lease land and purchase power separately, while others pursue integrated arrangements that combine facility and energy costs. The most sophisticated approaches align energy procurement with broader corporate financial strategies and sustainability commitments.

Regulatory Navigation

Complex regulatory environments govern both energy development and data center operations. Organizations must navigate interconnection procedures, environmental permitting, land use approvals, and utility commission requirements. Regional differences create additional complexity, as requirements vary significantly across states and utility service territories.

Recent regulatory changes reflect the urgency of addressing AI infrastructure needs. Multiple regional transmission organizations have implemented fast-track interconnection processes for qualifying projects. Texas Senate Bill 6 redefined interconnection processes for large electricity users. Understanding and navigating these evolving frameworks requires specialized expertise.

What Are The Key Implementation Challenges?

Intermittency Management

Renewable energy sources provide variable output based on weather conditions and time of day. Solar generation peaks during daylight hours but provides no power at night. Wind output varies based on weather patterns. AI operations cannot tolerate these variations, requiring sophisticated solutions to ensure continuous power availability.

Battery storage systems help bridge these gaps, but current technologies have limitations. Most lithium-ion battery systems can provide 2-4 hours of backup power, sufficient for short-term grid disturbances but inadequate for extended periods without renewable generation. Organizations must combine multiple strategies including oversized renewable capacity, large-scale storage, and backup generation to achieve required reliability levels.

Cost Structures

Renewable energy infrastructure requires significant upfront capital investment. Solar installations, wind farms, battery storage systems, and transmission upgrades can cost hundreds of millions of dollars before generating any power. Organizations must balance these capital requirements against operational savings and sustainability benefits.

Long-term economics generally favor renewable investments. Once operational, solar and wind facilities have minimal fuel costs and predictable maintenance requirements. Over 20-25 year time horizons, total costs often compare favorably to traditional grid power, particularly when factoring in price escalation for fossil fuels and potential carbon taxes or regulatory requirements.

Technical Integration

Integrating renewable generation with AI computing infrastructure requires sophisticated engineering across multiple domains. Power systems must handle variable input from renewable sources while delivering stable, high-quality electricity to sensitive computing equipment. Cooling systems must adapt to varying power availability. Monitoring and control systems must coordinate generation, storage, and consumption in real-time.

| Integration Challenge | Technical Requirement | Typical Solution Approach |

| Variable renewable output | Stable 24/7 power delivery to computing loads | Battery storage + oversized generation + grid backup |

| Power quality management | Clean electricity without voltage fluctuations | UPS systems + power conditioning equipment |

| Cooling optimization | Efficient heat removal with variable power availability | Hybrid cooling systems + thermal storage |

| Load management | Dynamic adjustment based on available power | AI-driven workload scheduling + demand response |

| Grid integration | Coordination with utility operations during contingencies | Smart inverters + microgrid controllers |

How Are Different Regions Approaching AI and Renewable Energy?

United States Leadership

The United States represents the fastest-growing market for AI data center development globally. American companies dominate AI technology development and deployment, creating concentrated demand for computing infrastructure. Four companies—Amazon Web Services, Google, Meta, and Microsoft—currently control substantial U.S. data-center capacity.

Regional variations within the U.S. create different opportunities and challenges. Virginia hosts the largest concentration of data centers but faces severe grid constraints and long interconnection timelines. Texas offers abundant renewable resources and available land but requires careful navigation of its unique deregulated electricity market. The Southeast provides competitive power costs and available capacity but faces growing scrutiny over environmental impacts.

European Market Dynamics

Europe pursues aggressive decarbonization goals that directly influence data center development. The European Union’s delegated regulation establishes a common rating scheme for data centers that includes energy efficiency and sustainability metrics. Countries including Ireland and Netherlands are implementing restrictions on new data center development due to grid capacity concerns and renewable energy availability.

These regulatory pressures are pushing European data center operators toward more aggressive renewable integration strategies. Some projects now require 100% renewable power from day one, forcing developers to pursue innovative solutions including direct connections to offshore wind farms and advanced energy storage deployments.

Asian Market Growth

China’s data center expansion currently relies heavily on coal-fired generation due to its electricity mix. However, government policies are driving rapid renewable deployment alongside data center growth. Provincial co-location mandates require new facilities in certain regions to include renewable generation capacity. Policies also prioritize data center construction in renewables-rich western China.

Japan faces unique constraints due to limited land availability and high electricity costs. The country is pursuing aggressive energy efficiency standards for data centers while exploring offshore wind development and small modular reactor deployment to address capacity needs.

What Does Success Look Like in Five Years?

By 2030, the integration of AI and renewable energy will have fundamentally reshaped data center infrastructure. Organizations that successfully navigate this transformation will operate facilities powered primarily by renewable sources, with sophisticated hybrid systems providing 24/7 reliability. Energy campus models will become standard for large-scale AI deployments, with computing infrastructure developed alongside dedicated renewable generation.

Technological advances will improve economics and performance. Battery storage costs will continue declining while capacity and duration improve. Small modular reactors will begin commercial operation, providing carbon-free baseload power. Advanced geothermal and green hydrogen systems will move from pilot projects to commercial deployment.

Regulatory frameworks will evolve to accommodate these changes. Interconnection processes will become more streamlined for projects that bring their own generation or demonstrate grid-supportive capabilities. Financial incentives will increasingly favor renewable-powered infrastructure. Carbon pricing mechanisms will make fossil fuel dependence economically disadvantageous.

The organizations gaining competitive advantages will be those that treated energy infrastructure as strategic rather than operational. By integrating renewable energy strategies from the earliest planning stages, they will achieve faster deployment, lower long-term costs, and stronger sustainability credentials. Hyperscale data center energy strategies that work today will become standard practice across the industry.

Frequently Asked Questions

How much renewable energy capacity is needed to power a 100-megawatt AI data center?

A 100-megawatt AI data center operating at typical utilization rates requires approximately 150-200 megawatts of solar generation or 100-120 megawatts of wind capacity to meet its annual energy needs. The oversizing accounts for capacity factors (solar produces power only when the sun shines, typically 20-30% of the time) and provides excess generation to charge battery storage systems. Most implementations also include 50-100 megawatt-hours of battery storage to ensure continuous operations during periods without renewable generation.

What are typical development timelines for renewable-powered AI data centers?

Integrated developments that combine renewable generation with computing infrastructure typically require 3-5 years from initial planning to full operation when pursuing traditional grid interconnection. Projects that utilize behind-the-meter configurations with on-site generation can reduce timelines to 2-3 years by bypassing lengthy interconnection queues. The fastest deployments occur in locations with existing grid connections, pre-entitled land, and streamlined permitting processes.

How do power purchase agreements for renewable energy work?

Power purchase agreements typically span 15-25 years and fix electricity prices for the contract duration. Data center operators agree to purchase all electricity generated by specific renewable facilities, providing developers with revenue certainty needed to secure project financing. These arrangements protect data center operators from fossil fuel price volatility while supporting new renewable generation deployment. Some agreements include physical delivery of electricity to facilities, while others involve financial settlements with separate physical power procurement.

What happens during extended periods without sufficient renewable generation?

Comprehensive hybrid systems address extended low-generation periods through multiple strategies. Battery storage provides power for short-term gaps of 2-4 hours. Oversized renewable capacity increases generation during available periods. Grid connections supply supplemental power when needed. For facilities requiring complete independence from fossil fuels, green hydrogen systems can provide multi-day backup generation, though these technologies are still emerging for widespread commercial deployment.

How does site location affect renewable energy integration?

Geographic location fundamentally determines renewable resource availability, grid infrastructure capacity, regulatory requirements, and development timelines. Regions with high solar irradiance or consistent wind patterns provide better renewable generation potential. Proximity to existing high-voltage transmission infrastructure reduces connection costs and timelines. States with supportive regulatory frameworks and streamlined permitting processes enable faster project development. The most successful deployments occur where multiple favorable factors align.

Building Tomorrow’s AI Infrastructure Today

The convergence of AI and renewable energy demands immediate action from organizations planning computing infrastructure. Traditional approaches that separate facility development from power procurement no longer work in markets where energy availability determines competitive positioning. Success requires integrated strategies that treat power infrastructure as foundational rather than supplementary.

Organizations must evaluate multiple factors including site selection, renewable resource availability, grid interconnection options, financial structures, and regulatory requirements. The complexity of these decisions requires specialized expertise in energy development, power systems engineering, and AI infrastructure requirements. How energy companies are powering AI demonstrates the sophisticated approaches needed to address these challenges.

The organizations that will dominate AI development over the next decade are making their energy infrastructure decisions today. Those decisions will determine which companies can rapidly deploy computing capacity at the massive scales AI requires. They will determine which organizations meet their sustainability commitments. They will determine who gains competitive advantages through lower long-term power costs and greater operational flexibility.

Hanwha Data Centers brings together the technical expertise, financial resources, and renewable energy focus required for next-generation AI infrastructure. Our team combines decades of experience in large-scale energy project development with comprehensive understanding of high-performance computing requirements. We develop renewable-powered energy campuses that integrate solar generation, battery storage, and strategic grid connections with powered land positioned for rapid data center deployment.

Ready to explore how renewable energy integration can power your AI infrastructure ambitions? Contact Hanwha Data Centers today to discuss your specific requirements and discover how our energy campus approach can accelerate your computing capabilities while meeting sustainability objectives.