Key Takeaways

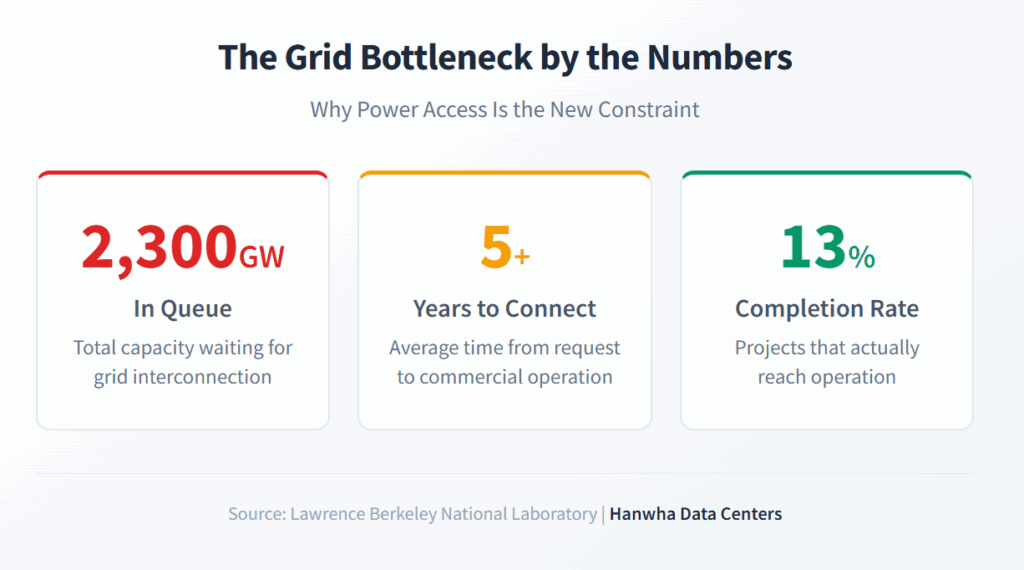

The single biggest constraint on new AI data center development is no longer land or capital. It’s access to grid power, with interconnection wait times stretching beyond five years in many regions.

- Nearly 2,300 gigawatts of generation and storage capacity are currently stuck in U.S. interconnection queues, more than the country’s entire installed power capacity.

- Infrastructure delays stem from four compounding factors: utility study backlogs, transmission upgrade requirements, permitting complexity, and equipment lead times.

- Smart site selection that prioritizes existing grid capacity and renewable energy access offers the fastest path to operational data centers.

Organizations serious about AI deployment must treat power infrastructure as a front-end planning decision, not an afterthought.

The race to build AI data center infrastructure has collided with an uncomfortable reality: there simply isn’t enough available power to go around. According to Lawrence Berkeley National Laboratory research, interconnection wait times have more than doubled over the past fifteen years, with projects now spending an average of five years in queue before reaching commercial operation. For hyperscalers and enterprise operators planning massive compute deployments, this represents more than an inconvenience. Data center grid limitations have become the defining constraint on when, where, and whether new facilities can come online at all.

What’s Causing Data Center Grid Limitations Across the U.S.?

The mismatch between exploding data center demand and available power infrastructure didn’t happen overnight. Multiple factors have converged to create what industry analysts now describe as the most significant bottleneck in digital infrastructure development.

The Queue Crisis Explained

Electric utilities and regional transmission operators weren’t designed for this kind of load growth. As of late 2024, approximately 10,300 projects representing 1,400 gigawatts of generation and 890 gigawatts of storage were actively seeking grid interconnection nationwide. Put another way: the capacity waiting in line exceeds the entire installed generating capacity of the United States power grid.

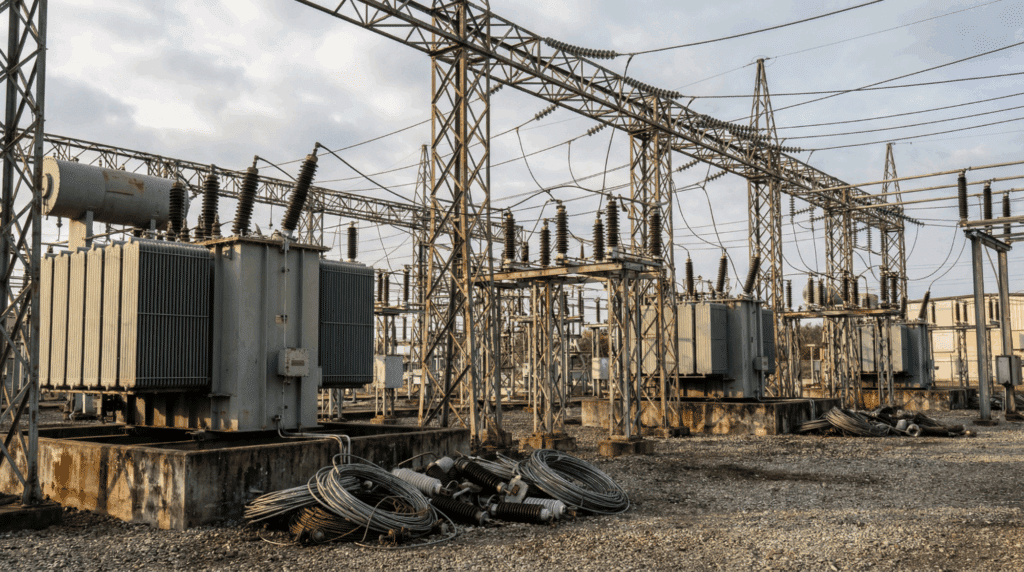

The problem isn’t limited to generation. Transmission infrastructure, substations, and distribution equipment all require upgrades to accommodate large loads. When data center developers submit interconnection requests, they’re effectively asking utilities to study whether existing infrastructure can handle their demand, then finance, permit, and build whatever upgrades are necessary. That process involves multiple stakeholders, competing priorities, and timelines measured in years rather than months.

| Challenge Factor | Impact on Data Center Projects |

| Queue Volume | 2,300+ GW waiting nationwide creates multi-year backlogs |

| Study Complexity | Large loads require transmission studies that trigger cascading reviews |

| Equipment Lead Times | Transformers, switchgear, and substations face 2-3 year procurement delays |

| Permitting Requirements | Environmental and zoning approvals add 1-4 years depending on jurisdiction |

Why Completion Rates Remain Stubbornly Low

Here’s the sobering math: of all capacity that submitted interconnection requests between 2000 and 2019, only 13% had reached commercial operation by the end of 2024. The remaining 77% was withdrawn, with 10% still stuck in various stages of review. These numbers reveal something important about the interconnection process: getting into the queue is easy, but getting through it is extraordinarily difficult.

Grid bottlenecks create a vicious cycle. When one project withdraws or significantly changes its specifications, utilities must restudy remaining projects in the queue. This cascading effect means that even well-prepared developers can face years of additional delay through no fault of their own. The more congested a queue becomes, the more likely any individual project is to face costly restudies. Understanding these data center grid limitations helps organizations plan more effectively.

How Are Electric Utilities Responding to Unprecedented Demand?

Electric utilities across the country are scrambling to adapt their processes, but the pace of regulatory reform hasn’t matched the velocity of demand growth. The gap between data center development timelines and grid infrastructure timelines has become a central challenge for energy access planning.

Regional Variations in Infrastructure Delays

Not all markets face identical constraints. Northern Virginia, the nation’s largest data center hub, has seen some proposed campuses require new substations and major transmission upgrades before any construction can begin. In Texas, CenterPoint Energy reported a 700% increase in large load interconnection requests between late 2023 and late 2024, growing from 1 gigawatt to 8 gigawatts in a single year.

Meanwhile, emerging markets in states like Idaho, Louisiana, and Oklahoma are attracting developer attention precisely because their grids aren’t yet overwhelmed. The search for what developers call “stranded power” (existing generating capacity that hasn’t been fully allocated) is driving significant geographic diversification.

Federal Regulatory Activity

The Federal Energy Regulatory Commission has been working to address queue backlogs through Order 2023, which replaced serial “first-come, first-served” study processes with cluster-based approaches. Projects now face stricter site control requirements, higher deposits, and withdrawal penalties designed to discourage speculative applications.

But FERC’s reforms primarily address generation interconnection, not large load interconnection. Recognizing this gap, the Department of Energy issued a directive in October 2025 proposing federal jurisdiction over new loads above 20 megawatts. The goal is to standardize procedures and create faster approval pathways for projects willing to accept operational flexibility, such as occasional curtailment during grid stress events.

What Strategic Approaches Actually Accelerate Energy Access?

Given the structural nature of these constraints, data center developers are adopting multiple strategies to reduce their exposure to interconnection delays. Some approaches focus on finding existing capacity; others involve bringing power resources directly to the site.

Site Selection as Infrastructure Strategy

Location decisions have always mattered for data centers, but the calculus has fundamentally shifted. Fiber connectivity, land costs, and tax incentives still factor into site selection, but grid capacity has become the primary screening criterion for serious projects. Developers are increasingly willing to compromise on other site characteristics if a location offers faster access to adequate power.

This shift has elevated the importance of early-stage infrastructure planning. Rather than securing a site and then figuring out power, sophisticated developers now work backward: identify where power is available, then assess whether those locations meet other project requirements. The result is a much tighter integration between real estate strategy and energy strategy. Avoiding data center grid limitations requires this proactive approach.

The Rise of Integrated Energy Campuses

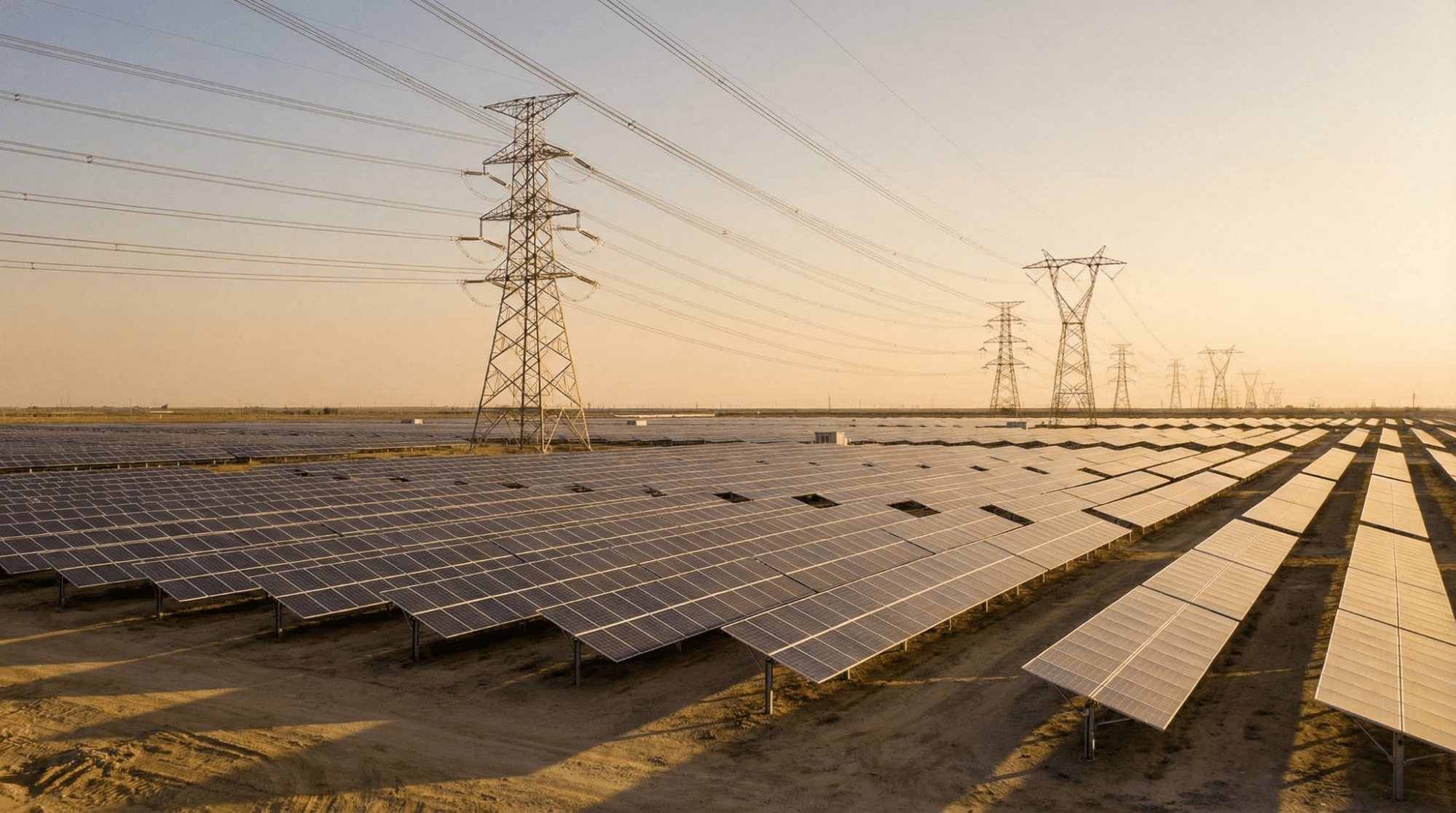

Forward-thinking infrastructure developers have recognized that the old model (where utilities provide power and operators just plug in) no longer works for gigawatt-scale deployments. Instead, comprehensive energy campus development has emerged as the fastest path from site selection to operation.

This approach combines multiple infrastructure elements into a single coordinated development:

- Strategic land acquisition in regions with favorable grid conditions

- Renewable energy resources that can be deployed faster than grid upgrades

- Water and wastewater infrastructure planning

- Fiber connectivity assessment

- Battery storage for demand management

The advantage isn’t just speed, though that’s significant. Integrated development also provides cost predictability, because operators aren’t fully dependent on utility rate structures or waiting for public infrastructure investments that may never materialize.

What Are the 5 Critical Success Factors for Navigating Grid Bottlenecks?

Based on the strategies that have proven effective in constrained markets, five principles consistently separate successful projects from those that stall in development limbo.

1. Prioritize Ready-to-Go Infrastructure Sites with existing substation capacity, available transmission headroom, or renewable energy sources that can be interconnected faster than traditional generation offer significant time advantages. The premium for “powered land” reflects this reality.

2. Engage Early with Utilities and Regulators Projects that maintain active relationships with utility planners and participate in regulatory proceedings face fewer surprises during the interconnection process. Understanding queue positions, upcoming reform impacts, and regional capacity constraints requires ongoing engagement, not transactional interactions.

3. Design for Flexibility Grid operators increasingly favor loads that can modulate demand during stress events. Building operational flexibility into data center designs through staged deployment, demand response capabilities, or on-site storage can unlock faster interconnection approval in some jurisdictions.

4. Diversify Geographic Exposure Single-market strategies carry concentration risk. Organizations pursuing large-scale deployments benefit from portfolio approaches that spread projects across multiple regions with different grid characteristics and regulatory frameworks.

5. Integrate Energy Planning with Development Timelines Power infrastructure can no longer be treated as something that happens after site selection. Energy strategy must be embedded in the earliest project planning phases, influencing location decisions, financing structures, and deployment schedules.

How Long Will Data Center Grid Limitations Persist?

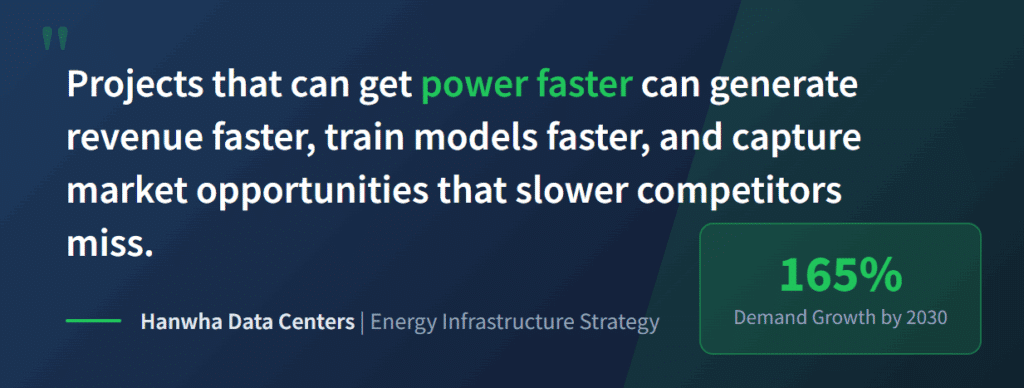

Forecasters generally agree that the most acute supply-demand imbalance will persist through at least 2028 or 2029, when new generation and transmission capacity currently under development begins reaching commercial operation. Goldman Sachs Research projects that data center power demand will increase 165% by 2030, requiring approximately $720 billion in grid investment over the decade.

| Timeline | Expected Grid Conditions |

| 2025-2027 | Most constrained period; new capacity insufficient to meet demand growth |

| 2028-2029 | New generation begins commercial operation; supply starts catching up |

| 2030+ | Structural improvements possible if current investment commitments materialize |

But these projections assume that current investment plans actually proceed on schedule, a significant assumption given permitting uncertainties, equipment supply chains, and the sheer complexity of transmission development. Building regional transmission lines currently takes seven to eleven years just for permitting, according to industry analyses.

The realistic takeaway: data center grid limitations aren’t a temporary condition that will resolve itself. They represent a structural feature of the infrastructure landscape that developers must plan around for the foreseeable future.

What Does This Mean for AI Infrastructure Investment Decisions?

For organizations evaluating significant compute investments, the grid constraint changes the fundamental decision framework. Speed to deployment, not just total capacity or lowest cost, has become a primary evaluation criterion. Projects that can get power faster can generate revenue faster, train models faster, and capture market opportunities that slower competitors miss.

This dynamic is reshaping competitive positioning across the data center energy sector. Organizations that have spent years developing expertise in site selection, utility relationships, and infrastructure development hold significant advantages over those approaching the market fresh. The ability to identify sites with available capacity, navigate interconnection processes efficiently, and coordinate complex multi-stakeholder developments has become a core competency. Overcoming data center grid limitations requires exactly this kind of specialized expertise.

FAQ

Why are data center grid limitations worse now than in previous years?

Several factors have converged simultaneously: AI workloads require dramatically more power than traditional computing, interconnection queue backlogs have accumulated over many years, transmission infrastructure investment hasn’t kept pace with demand growth, and equipment supply chains face extended lead times for critical components like transformers. The combination means that load growth is outpacing the grid’s ability to accommodate new connections.

Can on-site generation completely bypass grid interconnection requirements?

Not entirely. Even facilities with significant on-site generation typically require some grid connection for backup power, supplemental supply, or regulatory compliance. Additionally, some jurisdictions require facilities with on-site generation to be classified as “network loads” and share transmission upgrade costs. However, on-site resources can significantly reduce grid dependency and may qualify for faster interconnection in some markets.

What role does renewable energy play in addressing grid bottlenecks?

Renewable energy can be deployed faster than traditional generation in many cases, particularly when integrated with sites that already have transmission access or when paired with storage that allows more flexible grid integration. Solar and storage systems can often reach commercial operation in months once permitted, compared to years for grid-tied projects waiting in interconnection queues. This speed advantage makes renewables increasingly attractive for time-sensitive deployments.

How should organizations evaluate potential data center sites given these constraints?

Power availability should be a primary screening criterion, evaluated before detailed analysis of other site characteristics. Key questions include: What is the current capacity at nearby substations? How long is the utility’s interconnection study queue? What transmission upgrades would be required? Are there renewable energy resources that could accelerate power availability? Sites that score well on power metrics but less well on other factors may still be superior choices given the current constraint environment.

Partner with Infrastructure Leaders Who Understand Grid Realities

The power bottleneck isn’t going away anytime soon. Every major forecast shows demand growth outpacing supply additions through the end of the decade, with interconnection backlogs likely to persist even as reforms take effect. For data center operators and hyperscalers, this means that infrastructure partner selection has never been more consequential.

Hanwha Data Centers brings deep expertise in identifying, developing, and energizing sites for data center deployment. With a comprehensive approach that addresses land, power, water, and grid interconnection as integrated infrastructure challenges, Hanwha helps partners navigate grid bottlenecks and accelerate their path to operational capacity. Connect with the Hanwha Data Centers team to explore how purpose-built energy infrastructure can power your next data center project.