The U.S. digital infrastructure market is experiencing unprecedented growth, with research projecting a 165% increase in data center power demand by 2030.

- Hyperscale cloud giants are making massive infrastructure commitments for AI-ready data centers

- Power availability has become the primary constraint, with traditional data center markets hitting capacity limits

- Specialized AI infrastructure providers are emerging as critical players in this market transformation

- The shift from traditional colocation to power-first development strategies is reshaping site selection nationwide

Artificial intelligence is transforming how we think about digital infrastructure. The U.S. data center market was valued at $121.25 billion in 2024 and is projected to reach $357.89 billion by 2034, driven primarily by explosive AI adoption and cloud migration. In addition, global power demand from data centers will increase by 165% by 2030.

What makes this transformation particularly significant is the immediate nature of infrastructure bottlenecks emerging across the industry. Unlike previous technology shifts that evolved gradually over decades, current demands are forcing entirely new approaches to development, power procurement, and site selection. Organizations must now prioritize digital infrastructure providers, energy availability, cooling capabilities, and scalable architectures to remain competitive.

What Makes a Leading Digital Infrastructure Provider?

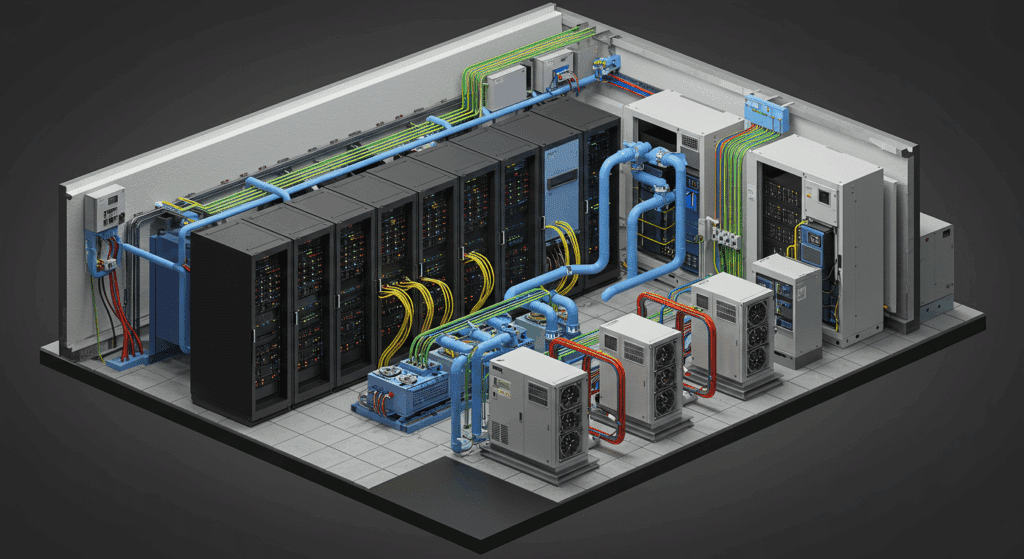

Modern leaders integrate power generation, land development, networking capabilities, and sustainability solutions into comprehensive platforms that can support current operations and future growth.

The most successful digital infrastructure providers share several characteristics that distinguish them from legacy operators.

- They demonstrate proven capability to secure and deliver reliable power at scale, as energy availability has become constrained in established markets. With estimates that global data center capacity could rise at 19-22% annually through 2030, infrastructure capacity planning requires sophisticated energy strategies.

- Leading providers maintain flexible, scalable infrastructure architectures that can adapt to rapidly changing technology requirements. AI workloads, for instance, require dramatically different cooling, power density, and network configurations compared to traditional computing. The ability to retrofit existing facilities or design new campuses specifically for these demanding applications separates industry leaders from followers.

- Successful providers demonstrate financial strength and strategic partnerships that enable them to reliably execute large-scale projects. As development timelines extend due to regulatory requirements and resource constraints, customers increasingly prioritize working with providers who have proven track records of completing complex infrastructure projects on schedule.

Understanding the U.S. Digital Infrastructure Ecosystem

The digital infrastructure landscape operates as an interconnected ecosystem where different types of providers serve complementary roles. Rather than competing directly, many infrastructure companies occupy distinct positions in the value chain, from foundational energy and land development through cloud services and specialized computing platforms.

Understanding these different categories helps organizations identify the right partners for their specific needs and recognize how various infrastructure components work together to enable modern digital operations.

Cloud Platform Operators

Microsoft Azure represents the hyperscale cloud category, with an $80 billion commitment for fiscal 2025 targeting AI-enabled infrastructure. These massive platform operators require substantial foundational infrastructure including reliable power at gigawatt scale, extensive land holdings, and renewable energy integration to support their global computing services.

Amazon Web Services (AWS) operates extensive cloud infrastructure across multiple U.S. regions, having spent $75 billion in capital expenditure during 2024. Their infrastructure requirements emphasize geographic distribution and energy redundancy, creating demand for sophisticated power procurement and land development partnerships.

Google Cloud Platform has committed $75 billion in 2025 for AI infrastructure development. Their approach integrates custom silicon with facility optimization, requiring partners who can deliver both renewable energy solutions and suitable development sites that meet their technical specifications.

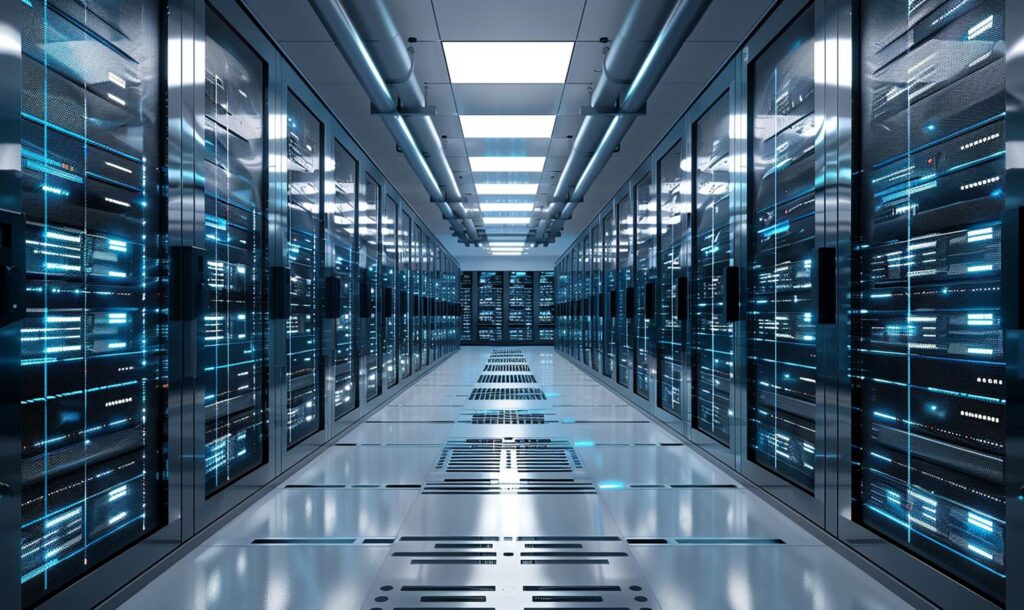

Colocation and Wholesale Facilities

Equinix operates 251 data centers globally across 70 metropolitan areas, focusing on network-dense environments where multiple customers share infrastructure within the same facility. Their model emphasizes interconnection and proximity to internet exchange points, serving customers who need physical infrastructure presence without the complexity of facility ownership.

Digital Realty Trust provides wholesale data center solutions where entire buildings or data halls are leased to single tenants. Their established utility relationships and experience securing large power allocations position them as important customers for foundational infrastructure developers who can deliver the energy capacity these wholesale facilities require.

Specialized Computing Infrastructure

CoreWeave has emerged as a GPU cloud specialist focused specifically on AI and high-performance computing workloads. These specialized providers require infrastructure designed from the ground up for extreme power densities, advanced cooling systems, and configurations that support dense GPU deployments for AI training and inference workloads.

Lambda Labs offers both cloud services and on-premises solutions tailored for AI developers, representing the growing category of computing-specific infrastructure providers. Their unique requirements create demand for infrastructure company examples that can deliver the power reliability and density needed for next-generation computing applications.

Telecommunications and Connectivity

Verizon leverages its telecommunications expertise to integrate connectivity, edge computing, and traditional data center services into comprehensive technology solutions. Their infrastructure combines network assets with computing facilities, requiring partnerships that can deliver both energy solutions and strategic site locations that optimize connectivity to end users.

Lumen Technologies (formerly CenturyLink) provides hybrid IT solutions that blend data center services with extensive network infrastructure. Their approach emphasizes managed services and connectivity integration, creating demand for infrastructure partners who understand both the power requirements of modern computing and the connectivity needs that define digital transformation initiatives.

Infrastructure Company Examples by Category

Understanding the diversity of digital infrastructure requires recognizing how different types of providers serve distinct market segments and use cases.

Hyperscale Operators focus on massive-scale cloud computing platforms that serve millions of customers globally. These infrastructure company examples typically operate facilities with hundreds of megawatts of power capacity and are optimized for maximum efficiency and cost-effectiveness across standardized workloads.

Colocation Providers specialize in providing shared infrastructure environments where multiple customers lease rack space, power, and connectivity within the same facility. This model offers flexibility and cost-effectiveness for organizations that need physical infrastructure presence without the complexity of owning and operating their own data centers.

Wholesale Data Center Operators focus on leasing entire facilities or large portions of buildings to single tenants, typically hyperscale customers or large enterprises. This approach provides customers with dedicated infrastructure while allowing the operator to focus on efficient facility management and power procurement.

Edge Computing Specialists are emerging as critical players in supporting applications that require low-latency processing close to end users. These providers deploy smaller facilities in distributed locations to support applications like autonomous vehicles, industrial IoT, and real-time analytics.

Where Are U.S. Digital Infrastructure Regional Hubs?

The geographic distribution of digital infrastructure has traditionally centered around established technology markets, but power constraints and AI demands are driving expansion into new regions across the United States.

Northern Virginia remains the world’s largest data center hub, housing over 250 facilities with massive concentrations of hyperscale infrastructure. The region benefits from fiber connectivity, proximity to government customers, and established utility relationships. However, power constraints are increasingly directing new development to alternative markets.

Phoenix has emerged as a major western hub due to abundant solar resources, available land, and a supportive regulatory environment. The desert climate presents cooling challenges but offers excellent solar generation potential that aligns with sustainability requirements.

Texas Markets, including Dallas and Austin, benefit from deregulated energy markets, abundant renewable resources, and business-friendly regulatory environments. The state’s independent grid system (ERCOT) provides unique opportunities for innovative power procurement strategies.

Emerging Secondary Markets like Columbus, Ohio; Des Moines, Iowa; and Richmond, Virginia are attracting investment due to available power capacity, lower costs, and strategic geographic positioning. These markets offer opportunities for organizations seeking alternatives to constrained primary markets.

What’s Driving Digital Infrastructure Growth in 2025?

Several trends are creating demand for digital infrastructure across the United States, with artificial intelligence serving as the primary catalyst for this growth.

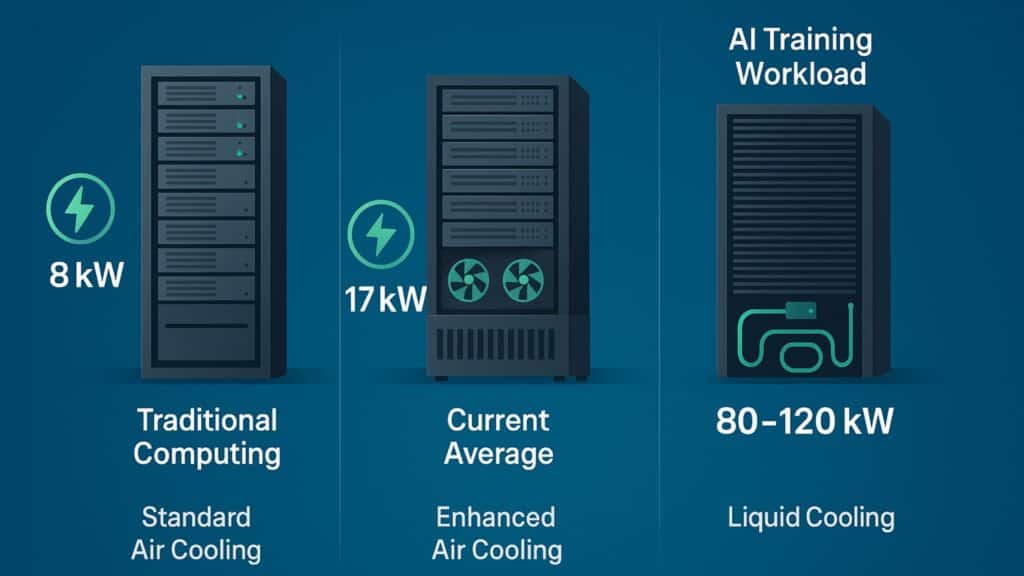

The AI infrastructure boom is driving exponential power requirements that traditional facilities can’t accommodate. Research indicates that AI workloads require significantly higher power densities than traditional computing. Average power densities have more than doubled from 8kW per rack to 17kW per rack in just two years.

Edge computing expansion is bringing processing power closer to where data is generated and consumed, creating demand for distributed infrastructure that can support real-time applications. Rather than sending all data to centralized centers, edge infrastructure processes information locally, reducing latency and improving user experience for applications like autonomous vehicles and industrial automation.

Corporate digital transformation initiatives continue accelerating, driven by competitive pressures and evolving customer expectations. Organizations across every sector are implementing AI-powered analytics, cloud-native applications, and data-intensive operations that require reliable, scalable infrastructure support.

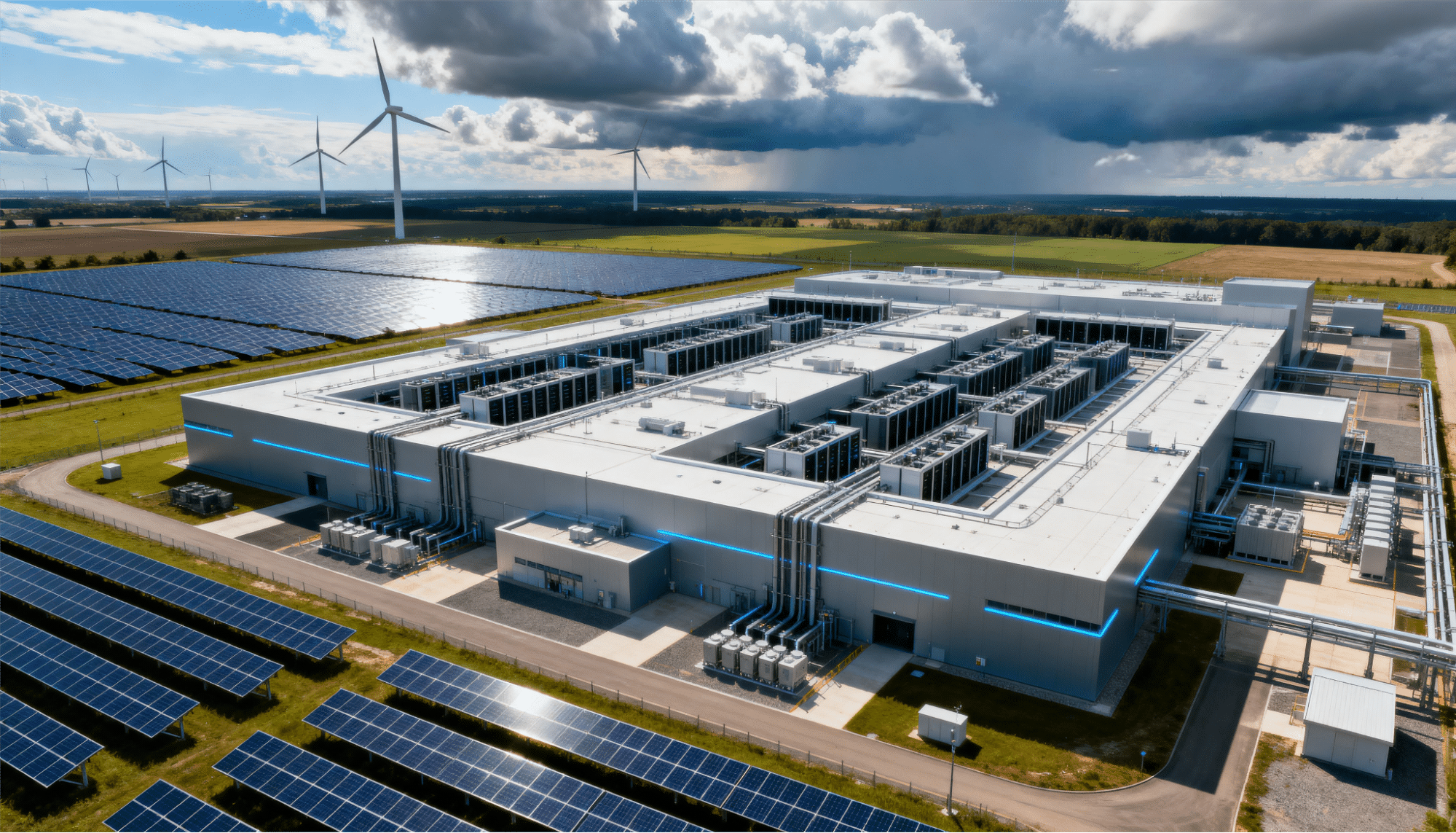

Sustainability mandates are influencing infrastructure decisions as organizations face increasing pressure from stakeholders, regulators, and customers to reduce their environmental impact. This trend is driving demand for renewable energy integration and energy-efficient facility designs that can deliver performance and environmental responsibility.

How Does Power Availability Impact Digital Infrastructure Choices?

Power availability is the single most critical factor in digital infrastructure planning and site selection decisions. Traditional approaches focused on proximity to population centers or existing technology clusters, but today’s reality prioritizes energy resources above all other considerations.

Many established markets like Northern Virginia and Silicon Valley now report extended timelines to provide adequate capacity for new data centers, with some utilities unable to accommodate new large-scale facilities for several years. Approximately $720 billion in grid infrastructure investment will be needed globally through 2030 to support data center growth.

This constraint is creating entirely new investment patterns across the United States. Smart infrastructure developers are identifying locations based on available renewable energy resources, proximity to transmission infrastructure, and supportive regulatory environments rather than traditional technology ecosystem factors. Secondary markets with abundant wind, solar, or other renewable resources are experiencing investment as hyperscalers follow available power rather than established business hubs.

The integration of renewable energy sources adds operational complexity that affects cost structures and development timelines. Organizations are focusing on sustainable energy solutions to meet cost and environmental objectives, requiring infrastructure developers to coordinate renewable energy projects with facility development schedules and long-term power purchase agreements.

FAQs

What is a digital infrastructure provider? A digital infrastructure provider develops, owns, and operates the physical and virtual systems that enable digital services, including data centers, power systems, connectivity networks, and cloud platforms. Modern providers integrate these components into comprehensive solutions that support everything from basic data storage to advanced AI applications.

Which companies dominate the U.S. digital infrastructure market? The market is led by hyperscale cloud providers (Microsoft, AWS, Google), established colocation giants (Equinix, Digital Realty), and emerging AI specialists (CoreWeave, Lambda Labs). Each category serves different market segments with distinct infrastructure requirements and service models.

Why is power availability so critical for digital infrastructure? AI and high-performance computing workloads require dramatically more electricity than traditional applications. With data center power demand projected to increase, power availability has become the primary constraint for infrastructure development, often determining site selection and project feasibility.

How are sustainability requirements changing digital infrastructure? Organizations increasingly prioritize renewable energy integration and energy-efficient designs to meet corporate sustainability commitments and stakeholder expectations. This trend is driving demand for infrastructure providers who can deliver reliability and environmental performance through integrated renewable energy solutions.

Partner with Next-Generation Infrastructure

Digital infrastructure is evolving, driven by AI adoption, sustainability requirements, and exponential growth in computing demands. Organizations that secure reliable, scalable infrastructure partnerships will maintain advantages as these trends accelerate throughout the decade.

Forward-thinking organizations need partners who understand both the technical requirements of next-generation computing and the energy challenges that define modern infrastructure development. The ability to deliver reliable power at scale, integrate renewable energy sources, and adapt to rapidly changing technology has become essential for long-term success.

Hanwha Data Centers specializes in developing comprehensive energy solutions specifically designed for the digital infrastructure challenges of today and tomorrow. Our integrated approach combines renewable energy development with land acquisition and energy campus creation to deliver the power-first solutions that modern data centers require. Contact us today to discuss customized solutions that meet your specific requirements.