Clean power solutions for AI data centers will fundamentally reshape infrastructure development as electricity demand could reach 12% of total U.S. consumption by 2028.

- Energy-compute convergence is creating revolutionary co-location models where renewable generation is directly paired with AI facilities

- ESG requirements now mandate 24/7 carbon-free energy procurement as hyperscalers face stakeholder pressure and regulatory compliance demands

- Grid interconnection delays are accelerating the adoption of on-site clean power solutions, including fuel cells, solar+storage, and emerging nuclear technologies

Strategic energy partnerships will determine which organizations can scale AI infrastructure effectively over the next decade as power becomes the primary constraint.

Data centers could consume up to 12% of all U.S. electricity by 2028, driven primarily by artificial intelligence workloads that are reshaping digital infrastructure at unprecedented scale. This seismic shift signals a new strategic imperative where clean power solutions for AI data centers become mission-critical for organizations pursuing leadership.

The convergence of energy and compute infrastructure is no longer a future consideration but an immediate strategic requirement. Meeting AI’s infrastructure demands will require more than $6.7 trillion in global investment by 2030, with energy access becoming the primary constraint to scalable deployment.

How Much of a Challenge is AI’s Energy Demand?

Global data center electricity consumption is projected to more than double to 945 terawatt-hours by 2030. This growth trajectory represents a 12% annual increase, more than four times faster than total electricity consumption growth across all other sectors.

Power requirements for AI data centers have evolved from traditional IT infrastructure. Where conventional data centers previously operated at around 8 kilowatts per rack, modern AI installations now average 17 kilowatts per rack, with AI training workloads demanding up to 80 kilowatts per rack. Nvidia’s latest GB200 systems may demand up to 120 kilowatts per rack, creating thermal and electrical loads that existing infrastructure can’t support.

The geographic concentration amplifies these challenges. Nearly 50% of U.S. data center capacity clusters in five regional hubs, creating intense pressure on local energy infrastructure and pushing regional systems beyond their design limits.

Traditional interconnection processes have become the primary bottleneck for new development. Previous timelines of one to three years have extended to 5+ years in many markets, with some projects facing complete cancellation due to power unavailability. This bottleneck is forcing decision-makers to rethink their approach to AI deployment.

Why Are Clean Power Solutions for AI Data Centers Now Mission-Critical?

The future of AI infrastructure depends on clean power solutions for AI data centers, driven by forces that make renewable energy procurement a competitive necessity rather than a sustainability preference.

Corporate ESG commitments have evolved from marketing initiatives to core business imperatives. Major technology companies now rank among the largest corporate renewable energy purchasers globally, with procurement strategies directly influencing infrastructure development timelines. These organizations require demonstrable progress toward carbon neutrality goals that influence investor relations, regulatory compliance, and stakeholder management, making ESG for AI compute a fundamental competitive requirement.

Procurement strategies are shifting since the emergence of 24/7 carbon-free energy requirements. Unlike traditional renewable energy credits that allow temporal flexibility, leading hyperscalers now demand clean power generation that matches their consumption patterns hour by hour. This requirement constrains the pool of qualified energy partners to those with substantial renewable generation portfolios and grid-scale storage capabilities.

ESG requirements for AI compute are becoming legally mandated in key markets. New York’s proposed Sustainable Data Centers Act would require facilities to align with state climate goals, while Michigan’s legislation mandates 90% clean energy procurement for data center tax exemptions. These regulatory frameworks signal the direction of policy development across major technology hubs.

Financial markets increasingly price energy security and sustainability into infrastructure valuations. Organizations with diversified renewable energy portfolios and proven grid-independent capabilities command premium access to capital markets, while those dependent on constrained grid resources face escalating operational and financial risks.

What Are the Five New Approaches to Clean Energy?

Corporate procurement teams have adapted their approach to energy sourcing. These approaches represent the cutting edge of energy-compute convergence:

1. Developing Energy Campuses

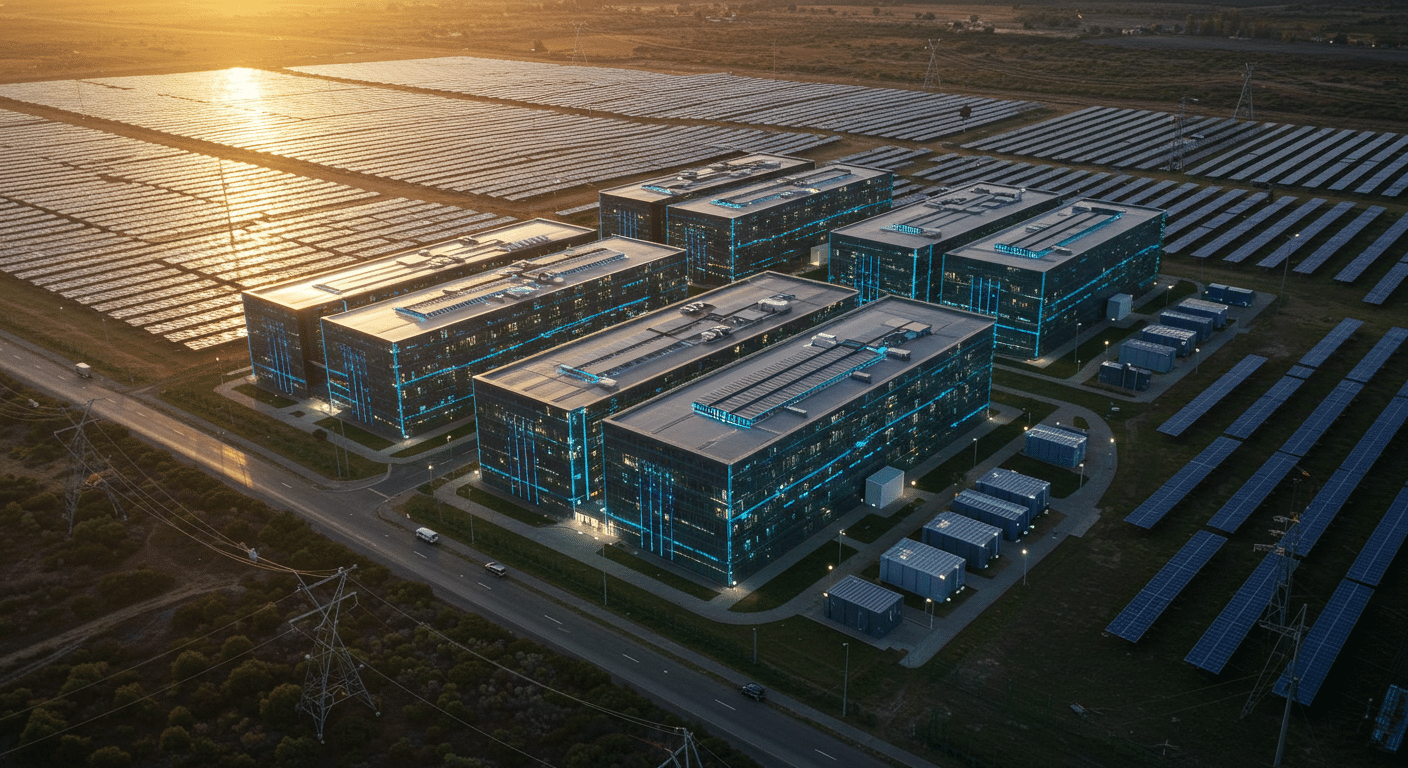

The most transformative development involves integrating renewable generation directly with data center infrastructure. This “power-first” approach develops industrial parks with gigawatts of capacity co-located with dedicated clean energy plants, exemplified by major technology companies partnering with renewable developers and private equity firms.

These energy campuses combine renewable generation, battery storage, and high-capacity grid interconnections on unified sites, enabling facilities to achieve carbon-free operations from initial deployment. The approach eliminates transmission losses, reduces grid dependency, and is the gold standard of clean power solutions for AI data centers seeking operational control over power costs and emissions profiles.

Leading energy companies are developing specialized campus models that integrate solar farms, wind generation, and advanced storage systems specifically designed for AI workload patterns. These projects typically include dedicated transmission infrastructure engineered for continuous peak utilization, representing the practical implementation of energy + compute convergence at enterprise scale.

2. On-Site Clean Power Generation

Grid-independent power generation is becoming essential for organizations facing extended interconnection timelines. Advanced fuel cell systems provide immediate operational capabilities compared to years-long traditional grid connection processes.

Modern fuel cell installations offer fuel flexibility that supports immediate operational requirements and long-term decarbonization strategies. Systems can operate on natural gas today while incorporating hydrogen capabilities for zero-emission operations as green hydrogen infrastructure develops.

How renewable energy powers data centers through integrated solar and battery storage systems provides both energy security and cost predictability. On-site solar installations paired with battery energy storage create self-sustaining energy ecosystems that reduce grid dependence while providing backup power capabilities during outages.

3. Advanced Nuclear Partnerships

Nuclear energy is experiencing renewed interest as technology companies commit to small modular reactor (SMR) technologies for reliable, carbon-free baseload power.

SMRs offer unique advantages for AI infrastructure, including compact footprints that enable co-location with data centers, shorter construction timelines compared to traditional nuclear facilities, and the ability to provide consistent power without weather-dependent variability. However, commercial deployment remains several years away, making SMRs a component of comprehensive clean power solutions for AI data centers rather than an immediate solution.

4. Targeting Geographies with Energy Access

Traditional data center site selection based on proximity to metropolitan areas is shifting toward power-first strategies that prioritize energy availability above other factors. Digital infrastructure trends show operators selecting sites based on regional renewable generation profiles and regulatory environments.

Secondary markets in Texas, Ohio, and other regions with abundant renewable resources are experiencing unprecedented infrastructure investment as hyperscalers prioritize power availability over proximity to existing technology clusters. This geographic shift creates new economic opportunities for communities with favorable renewable energy resources and supportive development policies.

International expansion follows similar patterns, with countries positioning themselves as data center destinations through renewable energy access and competitive regulatory frameworks. Nordic countries particularly benefit from hydroelectric resources and favorable cooling conditions that reduce overall energy requirements.

5. Grid-Interactive Smart Systems

Advanced power management systems enable facilities to optimize energy consumption patterns while providing grid stability services. These systems incorporate predictive analytics that forecast energy demand patterns and automatically adjust consumption based on renewable energy availability and grid conditions.

Battery energy storage systems serve multiple functions beyond backup power, providing frequency regulation services, peak shaving capabilities, and renewable energy time-shifting that maximizes clean power utilization. These grid-interactive capabilities can generate revenue streams while supporting overall grid stability.

Smart energy management extends to cooling systems, which represent up to 40% of total facility energy consumption. When comparing AI with traditional data centers, you can see how precision cooling systems powered by renewable energy can reduce energy consumption and carbon emissions.

How Are Investment and Policy Trends Transforming the Market?

The Department of Energy’s recent announcement of federal land availability for AI data center development signals government support for strategic infrastructure deployment. The initiative targets four sites, Idaho National Laboratory, Oak Ridge Reservation, Paducah Gaseous Diffusion Plant, and Savannah River Site, for private sector partnerships that could accelerate development timelines.

This federal support reflects broader recognition that AI infrastructure development represents a national competitiveness issue requiring coordinated policy responses. Streamlined permitting processes, grid modernization investments, and renewable energy deployment incentives are converging to create more favorable development conditions.

Private capital mobilization has reached historic levels, with global data center investment reaching $500 billion in 2024. This investment boom encompasses not only facilities development but also supporting energy infrastructure, including transmission upgrades, renewable generation capacity, and energy storage deployment. Clean power solutions for AI data centers represent both a necessity and a significant market opportunity.

What Are the Strategic Implications for Decision-Makers?

Organizations pursuing AI leadership must develop comprehensive energy strategies that balance immediate capacity needs with sustainability objectives. The complexity of modern energy systems requires partners with specialized expertise, financial resources, and operational excellence.

Timeline considerations are vital. Clean power solution deployment can range from months for on-site generation to years for major renewable energy campus development. Organizations that begin planning simultaneously with AI strategy development will possess significant advantages over those treating energy as an afterthought.

Partnership strategies should prioritize energy companies with demonstrated capabilities across multiple solution categories. The most successful partnerships combine technical expertise in high-performance computing requirements with comprehensive renewable energy development experience and financial strength to support long-term commitments.

Risk mitigation requires diversified energy portfolios that reduce dependence on single sources or technologies. Leading organizations are developing multi-pronged approaches that combine grid connections, on-site generation, and long-term renewable energy contracts to ensure operational continuity regardless of external infrastructure constraints.

Frequently Asked Questions

How quickly can clean power solutions be deployed for AI data centers? Deployment timelines vary by solution type. Advanced fuel cell systems can provide immediate deployment capabilities compared to years-long traditional grid connection processes, while comprehensive renewable energy campuses typically require longer development timelines, including permitting and construction phases.

What power densities should clean energy systems support for future AI workloads? Current AI installations average 17 kilowatts per rack, with AI training workloads demanding up to 80 kilowatts and 120 kilowatts per rack. Future generations may demand up to 360 kilowatts per rack by 2027, requiring clean power solutions designed with significant expansion capabilities.

How do ESG requirements impact energy partner selection for AI facilities? ESG compliance now requires verifiable 24/7 carbon-free energy procurement rather than traditional renewable energy credits. This constraint limits qualified partners to those with substantial renewable generation portfolios, grid-scale storage capabilities, and transparent carbon accounting systems.

What role does geographic location play in clean power solution effectiveness? Geographic factors influence solution viability, including regional renewable resource availability, grid interconnection capacity, regulatory environments, and local permitting processes. Optimal locations combine abundant renewable resources with supportive infrastructure and policy frameworks that enable rapid deployment.

How Can Organizations Power the AI Revolution?

Organizations that develop comprehensive energy strategies aligned with AI deployment requirements will possess sustainable competitive advantages. The time for incremental approaches has passed. The scale and urgency of AI infrastructure energy requirements demand strategic partnerships with organizations capable of delivering sophisticated clean power solutions at unprecedented scale and speed.

Hanwha Data Centers brings together the technical expertise, financial strength, and renewable energy focus required for next-generation AI infrastructure development. Our comprehensive approach to energy solutions for data centers combines large-scale renewable generation, advanced storage integration, and grid-independent capabilities specifically designed for AI workload requirements. Contact our team to discover how our clean power solutions can accelerate your AI infrastructure ambitions.